There really is not much users need to do to close the year in Acumatica; the financial year is closed automatically when you close the last period of the financial year. Thus, you should close the last period only when the company is ready to close the financial year. From a closing standpoint, the year-end close is no different than a month-end close other than there may be a year-end physical inventory, the period might be open longer for AP bills, and of course year-end audit, if applicable to the organization.

During closing of the financial year, the balance of Year-To-Date Net Income account updates the Retained Earnings account, which accumulates the net income over years. After that, the balance of the YTD Net Income account is reset to zero for a new fiscal year. The balances of the balance sheet accounts are transferred into the new financial year, while balances of other accounts are reset to zero.

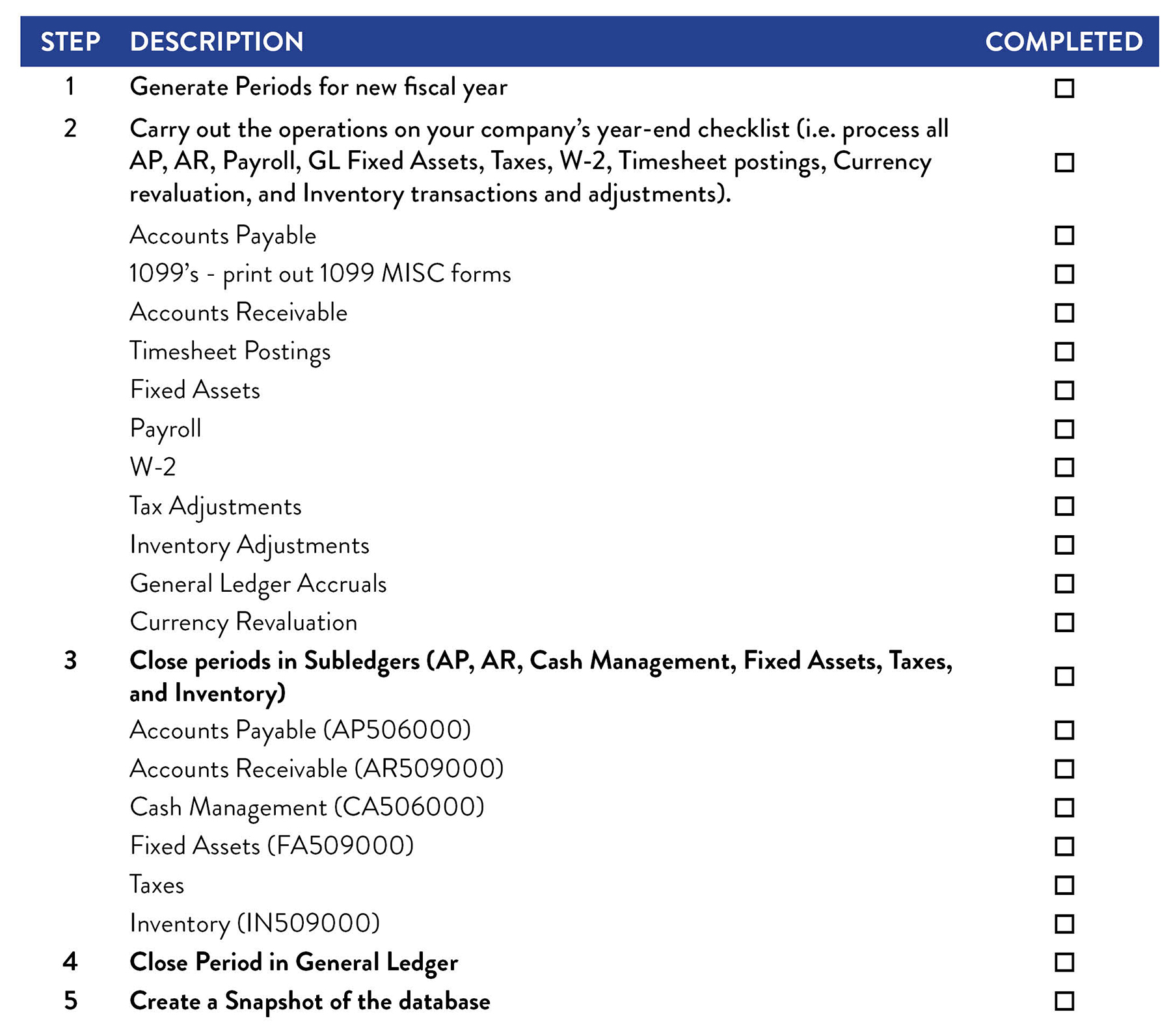

To make sure everything is accounted for, here is a checklist to go through for closing the fiscal year in Acumatica.

Acumatica Year-End Checklist

There are a few other considerations to take into account:

- Are there 12 or 13 periods?

- Did you perform a physical inventory?

- If yes, is it reconciled and posted?

- Has your audit been completed?

- Are there any adjusting journal entries from the audit that need to be booked?

If you need more information, there’s always the Acumatica Wiki, which can help walk you through specific steps and screens. Click here to go directly to information on Closing Financial Periods in Acumatica (this example uses 2020 R2 but the process will be the same).

If you need personalized assistance, Crestwood has a team of Acumatica experts who can help with any situation. Send us an email at sales@crestwood.com and we can connect you with our support staff.