Valuation methods are what determines how the costs of inventory items are calculated. There are several different methods you can use in Microsoft Dynamics GP. I recently had a client question how the various Inventory Valuation Methods in Dynamics GP differ. In this client’s case, the valuation they were using did not make sense for their company. I thought it would be worth listing the Inventory Valuation Methods that Dynamics GP has available, but a word of caution: we recommend that you talk to your tax accountant before changing the valuation method you currently use.

Inventory Valuation Terms to Know

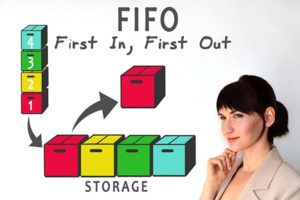

FIFO perpetual – Items purchased first are considered sold first (First In, First Out). Detailed information about the cost of all items is maintained, and the inventory is valued at its actual cost. The current cost for items is the cost of the item the last time it was purchased.

LIFO perpetual – Items purchased last are considered sold first (Last In, First Out). Detailed information about the cost of all items is maintained, and the inventory is valued at its actual cost. The current cost for items is the cost of the item the last time it was received.

Moving average perpetual – The cost of items with the same item number is totaled and an average cost is assigned to the items. The average cost of an item is revalued throughout the period as you enter increase transactions for items. The average cost also is used as the current cost. The formula is: (Current units x current moving average cost) + (New units x purchase price) / (Current units + new units)

FIFO periodic – Items purchased first are considered sold first (First In, First Out), and are valued at their standard cost. To update the standard cost, you can use the Inventory Year-End Closing window. At the end of the year, the standard cost can be adjusted to the current cost.

FIFO periodic – Items purchased first are considered sold first (First In, First Out), and are valued at their standard cost. To update the standard cost, you can use the Inventory Year-End Closing window. At the end of the year, the standard cost can be adjusted to the current cost.

LIFO periodic – Items purchased last are considered sold first (Last In, First Out), and are valued at their standard cost. To update the standard cost, you can use the Inventory Year-End Closing window. At the end of the year, the fixed cost can be adjusted to the Inventory Year-End Closing window. At the end of the year, the fixed cost can be adjusted to the current cost, or the cost of the item the last time it was received.

Cost variances—which can result with any of the valuation methods—are tracked in the General Ledger using the Inventory Variance account.

For additional help with navigating inventory valuation, please reach out to our team. This informative blog post was created because a client asked our team to solve a problem – your issue could be the next topic! Be sure to subscribe to our blog.